Confidence Comes with a Custom Alles Law Family Estate Plan

Have you been thinking about getting an estate plan? Do you know if you even need one?

Maybe you’ve thought about it but you’ve been procrastinating. You haven’t moved forward because:

Don’t worry. These are common questions and parents all around you are wondering the same thing.

The great news is that you don’t have to know the answers. That’s where the professionals come in. You just need to make an appointment and the attorneys guide you through the process.

It’s easier than getting a mortgage. Really.

GRKIDS team member Kelly and her husband were ready to take this step so they attended a free consultation with Alles Law in Grand Rapids, MI.

They were impressed with the care and detail they experienced at their session.

“The best part about working with Alles Law is that they take a tailored approach and really get to know you as a client,” Kelly said.

The attorneys at Alles Law understand people’s hesitation regarding estate planning. That’s why they work with clients to create a list of priorities and work them into their planning.

| Alles Law 5360 Cascade Rd SE, Grand Rapids, MI 49546 (616) 365-5055 |

You’ll Get a Personalized Plan from Alles Law

Attorney Tim Alles said one of his goals is to make sure that whatever situation a family is in, they get a customized plan that meets all of their wishes. In order to do that, Alles Law gets to know each client that comes into their office.

It’s necessary that they do this, Tim said, because in order to get to the core of the client’s situation they need to know quite a bit of detail about each family.

“Every situation is unique. That’s what makes our job so fun. Getting to know people. Getting to know their family. Everybody needs an estate plan, but there are a myriad of reasons as to why.”

Kelly agrees.

She and her husband had never discussed what would happen to their kids and assets if something were to happen to both of them. Tim took them through many life scenarios they hadn’t considered.

“This was not a generic informational meeting or sales pitch. Tim has done over 2,500 estate plans, and he knows exactly what we need to consider,” Kelly remarked.

No More Myths: What You Really Need to Know About Estate Plans

“People are often confused about what an estate plan actually is,” says Jordan Bush, another Alles Law attorney

Many people think estate planning only applies to your stuff and who gets it after a person dies. But there is so much more that falls under the umbrella of estate planning.

Yes, who gets your stuff is a big part of estate planning, but so is:

Another myth: Estate planning just for millionaires.

According to Jordan, “The biggest misconception we see in our practice is people thinking they have enough money to necessitate an estate plan. So we try to educate. We have legal tools that we can use to accomplish the goals that our clients identify.”

I Need to Know My Kids Are Going to Be Okay

Alles Law serves families well because they are parents themselves.

Jordan goes on to tell us that,

We have kids. We live this out every day, not just because we have clients.

These are issues that are in our lives. I need to know that if something happens to me – if I’m incapacitated or I pass away – that my kids are going to be okay.

I know they are because my plan is airtight, and I want all of my clients to have my same confidence in their plan that I do with mine.

This is not something that we’re just talking to you about in the nebulous, in the theoretical. This is what we live. We know exactly what the concerns are. We’re parents, too.

You’ll Get Along with the Alles Law Team

Another reason many people put off creating an estate plan? Interacting with lawyers can be intimidating. As Tim puts it, “lawyers have a reputation of making things confusing, expensive, and complicated.”

Don’t worry. Alles Law attorneys are down to earth and they know this experience can be emotional.

“A lot of our clients come in, and we might be the first lawyers they’ve ever met. They’re concerned about being confused. We’ve been told that people are afraid lawyers will talk down to them.”

The lawyers at Alles Law are not scary people. They are very personable and work to make their clients comfortable, too.

Kelly said she didn’t feel talked down to, rather Tim talked them through their estate plan in “regular people” language. Tim explained it in terms that anyone could understand – not just a lawyer.”

Beyond this, there’s the elephant in the room to contend with.

Nobody wants to talk about death.

But talking about death is not going to make it more likely to happen. What talking about it does is provide a sense of relief. You are taking care of the big, important details for your family and now have one less thing to worry about. This feels good.

Life Map: Focus on What Your Family Needs

Clients can all expect to be treated with courtesy and to know all prices up front. That’s where the similarities between families end.

Alles Law estate planning is based solely on the priorities of the client.

Here’s how the process works:

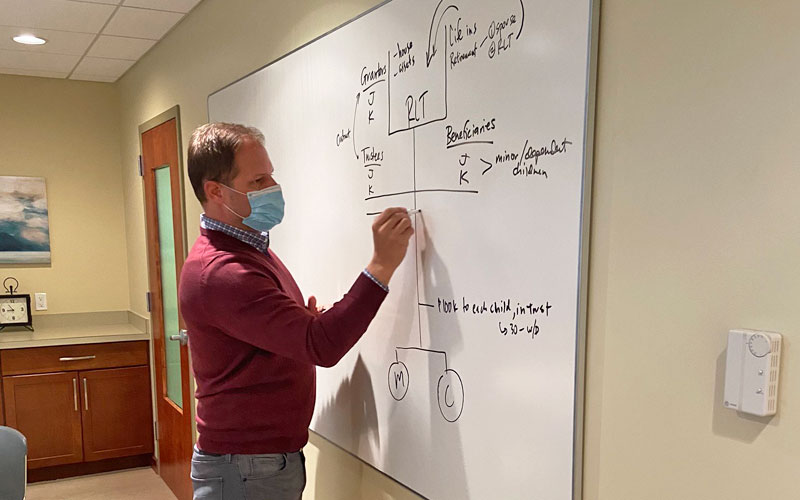

worksheets are provided to families that raise questions to be discussed in a free consultation. Then a plan is clearly drawn out with the client called a .

- Parents schedule a free Alles Law Consultation

- At the consultation, an Alles Law attorney gets to know the family, leading them through questions via their proprietary worksheets

- A plan, called a Life Map, is clearly drawn out with the client.

As the Dentlers found out, you can have your entire estate planned in just one meeting.

“By the time our consultation was done, we had a solid plan for a revocable living trust, wills, and the applicable Power of Attorney documents, health care, and financial. We know who will have guardianship of our kids if something happens to us, and who will be in charge of the trust.”

And that’s that.

You can have all your questions answered and confidently understand where you stand on all issues pertaining to your estate.

After that, you will only need to update Alles Law with any life changes as they occur. You will also get a yearly “Planniversary” check-in from Alles.

Already Have Documents in Place? Alles Law Will Review Them With You

If a client comes into Alles Law with a previously drawn plan in place, Alles will treat them as though they are starting from scratch.

“A lot of people will come in with a plan, and they give us a copy of it, and they say, ‘Is it good?’

We’re going to ask them all the same questions that we would have for somebody who didn’t have a plan. Then we’ll take all your answers and we’ll match it up to the existing plan and say ‘Okay, these are all the things you said are important to you.’ ”

“Kind of like when you go to the doctor and you get a second opinion. That doctor probably isn’t going to read what that first doctor wrote down. They’re going to say, “I don’t want to be clouded by that.” Actually I want to ask you all the questions I want to ask, and get my own opinion, then I want to look at it.”

Transparent, Fixed Pricing Means No Surprises

Not knowing how much an estate plan will cost holds many people back from starting the process.

Some people try do-it-yourself plans for this reason. But before you go that route, call Alles Law and schedule a free consultation. They will not pressure you, and you will come away with knowledge.

Along with educating clients and providing tailored estate plans, Alles Law promises transparent pricing.

“I don’t want price to be a barrier. A lot of times if you’re billing at an hourly rate, people walk away thinking ‘Boy, I wonder how much that is going to cost me.’ That’s not giving them any sort of confidence,” Tim said.

Alles offers a custom fixed price which is determined by the complexity of your plan.

“After we’ve gone through the whole thing, we discuss whether we’ve reached every goal you have. Then I will share with them the price and go over why,” Tim said.

“It’s not the same one-price-fits-all because everybody is unique. We want to have clients who feel comfortable that the clock isn’t ticking, and that they can share their most important things with us. Literally.”

Kelly said after her consultation, they knew exactly what the pricing would be and why and that everything made sense to them.

“They are 100 percent transparent about pricing. By the end of the consultation, we knew exactly how much it would cost to complete our estate plan. It is a flat rate with no hidden costs down the line.”

(You can schedule your own free consultation by calling Alles Law at (616) 365-5055.)

Experience Confidence in Knowing Your Family’s Future is Secure

One of the best reasons to get an estate plan is peace of mind.

Kelly and her husband found that getting their affairs in order was like releasing a huge weight off your shoulders. Everyone should feel that.

“I certainly wouldn’t want to leave a financial burden or added stress on my family in the event of our untimely passing. Having a Life Map is having peace of mind.

“My husband and I left the meeting and couldn’t stop talking about how much we learned and how we should have done this sooner,” Kelly said.

Tim said it is important that a family feel confident with their estate plan and that they have a good understanding of their plan’s components.

“We want to make sure that we have people who are confident that they have a good custom plan, know why they are doing it, and that they’re not going to get billed extra for something they didn’t expect. Our number one goal for our clients is that they are confident that they did the right thing.”

Draft Your “Team” Now, Before You Even Need It

Tim is often asked to be a part of the “team” for his clients.

“I can’t stress enough the team aspect,” urges Tim. “An independent third party who does this every day for a living must be involved on the administration end of things.”

Most people create an estate plan to reduce the burden on those who are left behind, and the best way to do it is to assemble a “team” of helpful professionals.

People to identify:

“Once we get that team together, and we share that information with everybody … we can divide and conquer,” Tim says.

While You’re at It, Talk to Your Parents About Their Estate Plans, Too.

Now is a great time to make sure your aging parents also create legal documents in order to make things much easier in the future.

Tim Alles understands the stresses involved in extended family estates and advises that getting your own estate plan goes a long way in convincing your elderly parents to take care of their own affairs.

Stressing the reasons you want your parents to have a plan can avoid thoughts of selfish motives. Tim recommends telling them it’s not about what material items that they’re leaving behind. It’s about them having a plan, not only for death, but if they become incapacitated.

“The best way to soften it would be to truthfully say, ‘We just got this done. We couldn’t believe how much we learned, and we recognized how much we didn’t know. Have you done it, or have you revisited it in the last five years?” suggests Tim.

One of the biggest reasons to have an estate plan is to preserve relationships between family members. In court, an executor needs to be appointed, and often there are disagreements over who that person should be.

Aging parents should also decide who gets what among the family heirlooms. Most of the time, siblings fight over the items that have sentimental value to the family more than any money.

“If they don’t do something about it, it significantly increases the risk that the relationships between those siblings will not be preserved,” Tim says.

You Should Let the Experts Do It. Really.

Jordan said estate planning is a very specialized profession that the general public doesn’t often understand. There can be drastically negative results for people who have inadequate plans or no plan at all. Resist the urge to create an estate plan yourself.

“There are so many legal implications that people don’t understand unless they are experts in estate planning. The general public doesn’t really understand, and nor should they because this isn’t what they do on a daily basis. They should be worried about living their lives and let us be the specialists.”

You can schedule your own free consultation by calling Alles Law at (616) 365-5055.

Alles Law

5360 Cascade Rd SE, Grand Rapids, MI 49546

616-365-5055

So what are the few pricing ranges depending on the complexity of the plan?