An Estate Plan is a Gift to Your Kids & Family: It Relieves Them of Endless Paperwork and Tough Decisions

You hear people talking about wills, trusts, and estate planning – and you know you should probably have one. It’s on your to-do list, but it never quite makes it to the top.

It seems self-explanatory, right? If you die, your kids will get your money and they’ll move in with your folks.

Why the need for an elaborate plan? And who wants to talk about dying anyway?

Here’s the biggest and best reason – an estate plan ensures your children aren’t caught up in court-appointed care, and it gives your loved ones space to grieve instead of dealing with endless paperwork and tough decisions.

Debunking the Top 5 Myths About Estate Planning

I spoke with attorney Tim Alles, founder of Alles Law, to find out what exactly goes into an estate plan and why it’s an essential tool for parents looking to protect their children’s futures.

There are many misconceptions about estate planning. We want to set the record straight and make it easier for you to protect the ones you love.

Alles Law is sharing the five biggest estate planning myths they encounter when working with families, to help take the mystery out of planning for the unthinkable.

Myth 1: My Kids Can Just Live With My Parents if Something Happens to Me, Right?

It is not enough to assume your children will live with your parents or other family.

You need legal documents in place to appoint a guardian for your kids (so it’s clear who the children will live with), and a trustee to manage the assets in your estate (this way, you can determine how your money is used to look after them).

If you don’t have this, your family will have to work with the court, where a judge has the final say on who raises your kids.

An estate plan ensures the best outcome for your kids, and it also relieves the burden on family, because they will know exactly what to do.

It’s a lot to ask someone to handle both child raising and financial management, on top of their own needs.

Having a plan in place avoids leaving anything to chance, and secures the safety and security of your children if the worst happens.

Myth 2: All I Need is a Will. All Those Other Documents are Too Complicated!

A will is a good place to start, but it’s incomplete.

Maybe you’ve already got a will. You filled out a generic questionnaire online and have a document printed out somewhere that covers the basics.

But what about your finances? You’ll need more than a will to properly handle this.

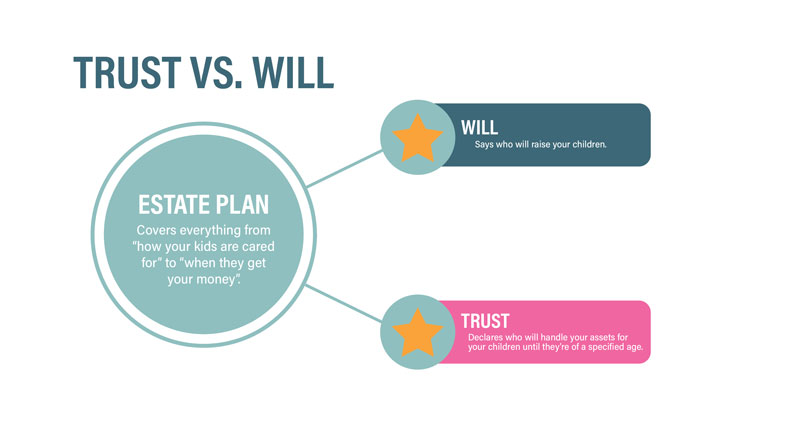

A will names a guardian for your children. This person makes sure your kids are fed, get to school and ultimately transition to adulthood.

A trust appoints someone to manage your money for the benefit of your children.

A will and a trust are both necessary legal tools, and with the right estate planning attorney, it won’t be difficult to get your plan in place.

Myth 3: I Don’t Have Enough Assets for a Trust, So Why Do I Need One?

You probably have more assets than you realize.

Do you have a 401K or life insurance plan? How should those funds be responsibly handled?

Many people only consider their home and bank accounts as assets, but what about your life insurance plan or retirement savings?

Once you count that as part of your estate, you suddenly have a lot more assets than you thought!

A trust names a trustee, aka, “the person who will be in charge of your finances when you die.” It also names who will receive money, and how they’ll get it.

Until I spoke to Tim, I wasn’t aware that the role of trustee is different from that of the guardian.

And I was surprised to learn that estate planning attorneys recommend that these roles are filled by two different people!

Tim advocates playing to people’s strengths and giving different people different roles to avoid complications.

“You want a check and balance relationship between the guardian and the trustee,” Tim advises.

“It might make sense, for example, for a sibling to be the guardian and for the grandparents or other siblings to be the trustees.”

Tim has made that decision for his own family.

If he and his wife die while his children are minors, one family member will look after his children as their guardian, and another family member will look after the finances as the trustee.

It all depends on what’s best for your family.

Myth 4: I’m Sure My Kids Will Handle our Finances Just Fine After They Turn 18.

Right now, your kids may be very mature and seem like they could handle the responsibility of lots of money dropped in their lap.

But after the death of a parent (or parents), you’ll never know what kind of decisions they’ll make.

A complete estate plan gives your children space to grieve without suddenly needing to make several financial decisions when they turn 18.

That is why you appoint someone you trust to distribute funds to your children when you deem appropriate.

Then, at a certain age or ages, your kids can access the money as you indicated in your trust. This is where you get to personalize your estate plan, because you can choose any age you like.

For example, in your kids’ teens and twenties, Tim suggests your trustee have the final say over what money your kids get.

So if your 17-year-old is asking for a car, the trustee might help look for a reasonable option instead of the latest sports car your kid is begging for.

You can even lay out a staged progression for releasing funds.

Some families opt for something like this:

Tim shares that suddenly getting a lot of money at an early age could be a huge burden for a child, especially at such a distressing time.

“Let’s not let money be a curse on our kids at 18!” says Tim.

Myth 5: Why Can’t I Just Write My Own Will and Have it Witnessed? A Big Estate Plan Will Cost a Fortune.

For starters, estate plans probably don’t cost what you think.

And documents like an online will might not even be valid in Michigan.

Ultimately, Tim asks, “Do you want to be confident that your plan will take care of your kids?”

Some families come to Tim with no plans in place. Others have a short will they prepared online or that they put together themselves.

After reviewing them with clients, Tim finds that most of these do not meet State law requirements and aren’t valid, which means your family would still have to work with the court if you die!

An online will can’t get to know your family and your needs, either.

Alles Law gives you a personalized experience, asks the right questions you probably haven’t thought of, and designs a plan that covers you in every event.

Alles Law is competitively priced for the services they offer and they also offer a FREE initial consultation, with no obligation.

OK, I’m Sold on Getting an Estate Plan. What Happens Next?

First, schedule your free consultation with Alles Law.

Consultations last 45-90 minutes. There is no obligation after the first meeting.

During the first meeting, Tim or another one of Alles Law’s attorneys will take you through a personalized planning checklist. This helps them pick up the details that make your family unique – details that an online form cannot capture.

Your attorney will then draw out your estate plan on a whiteboard and incorporate the specific things you want, as well as what they suggest your family needs.

That’s the benefit of meeting with an estate planner that knows YOU.

You’ll be amazed at the peace of mind a complete estate plan can give you. It’s one of the greatest gifts you can give to your family.

Schedule the free consultation today, and check it off your never-ending to-do list.

Alles Law

5360 Cascade Road SE

Grand Rapids, MI 49546

(616) 365-5055