Feel Confident that Your Kids Will Be Provided For With an Estate Plan from Alles Law

Snuggling with your kid, celebrating a soccer win, laughing at family jokes… parenting can be a lot of fun.

But what happens if we can’t make our own decisions or pass away?

Even though it’s not exciting, planning for what happens when we die is very important, especially if we have kids.

Everyone, especially parents, needs to have a plan in place for what should happen if you are unable to make your own medical or financial decisions.

Alles Law is eager to help you set up your own personalized estate plan.

The Top Six Questions Parents Ask Alles Law

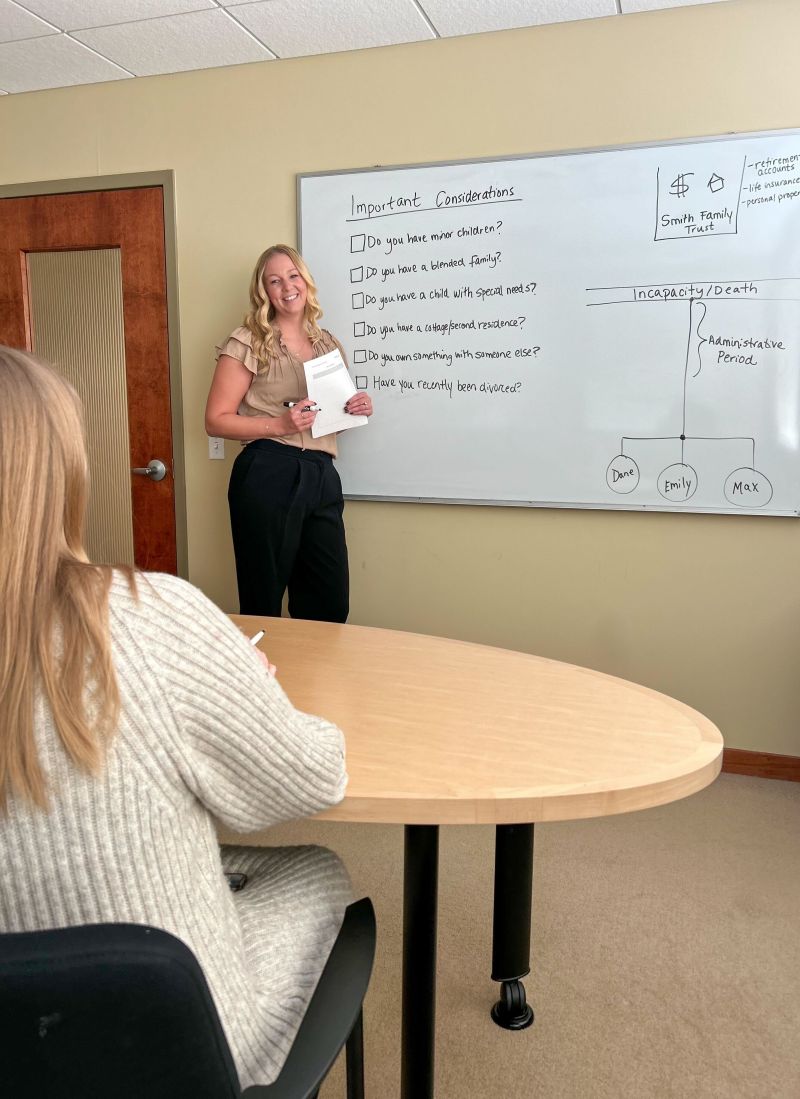

An Estate Plan can feel very mysterious if you don’t have one.

The attorneys at Alles Law are passionate about educating families on the process, and are answering the six common questions about estate planning.

1 – My husband and I have two vehicles, a modest house and three kids. We are a “typical” middle class family. Aren’t estate plans for people who have an “estate”?

Tim Alles, lawyer and owner of Alles Law, explains, “An estate plan is for everyone. It’s not just about ‘who gets my stuff when I die?’”

You may think you don’t own much, but assets also include life insurance, retirement accounts and investments. Most people have these.

2 – “My sister agreed to take care of our young kids if we die. How can we make this legal?”

You need a will and you also need a trust.

As parents, we know that we need someone to take care of our kids if we die before they’re 18.

Parents need both a legal will and a trust in place to protect and provide for their children if they pass away or become incapacitated in order for their wishes to be followed and keep things out of the courts.

Both documents provide the legal authority for a named guardian.

“A will names a guardian,” explains Tim, “and the trust provides for your children’s needs with the help of a trustee that you have appointed.”

The guardian, who is taking care of your children, will request money from the trustee to pay for your kids’ expenses, like food, clothing, medical bills, tuition, or anything else they need.

“We recommend two different people for the guardian and trustee,” advises Tim. This keeps the financial focus on the children and not the guardian.

3 – What’s the difference between a will and a trust and what do they do?

A will names who will take care of your children. A trust outlines how the money is managed and distributed for the benefit of the children.

“If you just have a will, your estate will go through probate,” Tim explains. “A will is important for naming the guardian of your children, but it won’t keep your estate out of court.”

If your family has to go through the court system, then all of your assets will be placed into a conservatorship account, which is governed by the court. And once your minor children turn 18, all of the money in that account is released directly to them.

With a trust, you can choose when your children get access to their inheritance.

“A lot of parents like to use landmark numbers,” explains Tim. Instead of giving 100% of the funds to an immature 18 year old, they can choose to give 25% to them at age 25. And then 50% at age 35 and the full 100% at age 40.

Having a trust means it’s up to YOU, not the courts.

4 -“Who will take care of our children if we’re in the hospital?”

Your will nominates who you want to take care of your kids if you’re incapacitated (unable to take care of them yourself for a finite period of time).

We often think about who will take care of our children if we pass away. But do we think about who would take care of them if we’re in an accident and hospitalized for weeks or months at a time?

Nominating a guardian in case you’re incapacitated is also an important part of an estate plan.

The guardian is named in a will and then a judge will appoint them as legal guardian while you are incapacitated. This gives the guardian the legal authority to make medical and financial decisions for your kids while you cannot.

“We often see families fight over who gets to take the kids,” comments Tim. “An estate plan eliminates the arguing.”

Power of Attorney settles who makes YOUR decisions while you can’t make them. The estate plan settles who takes care of your kids while you can’t.

Your will can also be amended. The choice of a guardian doesn’t have to be a forever choice. The person you choose now may not be the person you choose in a few years. When you design your estate plan you are allowed to (and should!) update it every few years.

If you’re putting off creating an estate plan because you’re having difficulty deciding who that guardian will be, know that you can always update it later. It’s better to have some sort of plan, instead of no plan at all.

5 – “How can I support and protect my college-age kids?”

Get them medical and financial Power of Attorney and HIPAA authorization through a young adult estate plan.

My oldest is ten years old; age18 seems so far away. So much changes once a person reaches 18 and a good estate plan changes as the kids grow.

As parents of children 17 and under, we are in charge of their medical decisions and have access to all of their medical records. After they turn 18, that ends.

Once a child turns 18, children need their own legal documents. They need their own medical and financial power of attorney in order for their parents to have continued access.

A young adult estate plan through Alles Law includes a medical power of attorney, financial power of attorney and a HIPAA authorization.

“The HIPAA forms at the doctor’s office need to be renewed every year,” Tim says. “The one in the estate plan is good until you change it.”

If your 20 year old child gets into a car accident, their doctors cannot release any medical information to you. If you want access to these documents, you will have to go through the courts.

Avoid the courts by having medical and financial Power of Attorney and a HIPAA authorization for all of your young adult children.

“These three documents are the least fun 18th birthday gift ever,” laughs Tim.

6 – “If my child has special needs, how do I make sure they are cared for?”

Ask an experienced lawyer about a Special Needs Trust.

Sometimes children with special needs require an advanced level of care. This makes the guardian selection even more important and even more vital to do it yourself in an estate plan.

Special needs trusts also helps with medical coverage and care. If you die and leave inheritance to your child, it could disqualify them from Medicaid and require that child to pay out of pocket for medical care.

This is because children only qualify for Medicaid once they reach 18 if it’s clear they will never be able to work and provide for themselves, based on financial need.

“They basically can’t have any money in order to qualify,” explains Tim.

“Avoid losing Medicaid and other government benefits by setting up a special needs trust,” Tim says.

The special needs trust ensures that there’s money set aside to care for the child and that it does not count against them in terms of Medicaid eligibility.

More About Alles Law

Know exactly how your kids will be cared for if you aren’t able to do it. Stay out of probate court and distribute your assets in the way that YOU want so that your kids are raised the way you want.

Contact Alles Law today for your FREE estate planning consultation.

Alles Law

Simplifying the path to a custom estate plan you feel confident about.

Call today for a free consultation!

Thank you for explaining that you should choose a guardian for your kids if you’re incapacitated. My sister is thinking about writing a will or estate plan now that she has kids. I’ll have to share this with her so that she can be sure to consider this as well.